QuickLinks-- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | ||

Filed by a Party other than the Registrant / / | ||

Check the appropriate box: | ||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to | |

FPL | |

| (Name of Registrant as Specified In Its Charter) | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| /x/ | No fee required. | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

/ / | Fee paid previously with preliminary materials. | |||

/ / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

FPL GROUP

FPL GROUP, INC.

Group, Inc.

P.O. BOXBox 14000

700 UNIVERSE BOULEVARD

JUNO BEACH, FLORIDAUniverse Boulevard

Juno Beach, Florida 33408-0420

- -----------------------------------------------------------------

- -----------------------------------------------------------------

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

MAY 24, 2002

Notice of Annual Meeting of Shareholders

May 23, 2003

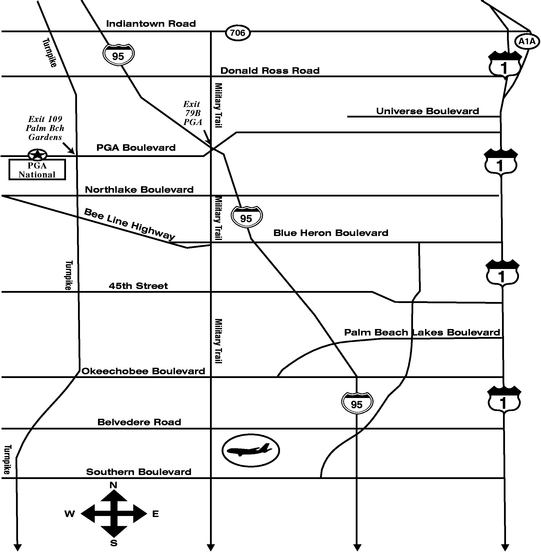

The Annual Meeting of Shareholders of FPL Group, Inc. will be held at the PGA National Resort, 400 Avenue of the Champions, Palm Beach Gardens, Florida, at 10:00 a.m. on Friday, May 24, 2002,23, 2003, to consider and act upon:

-Election

- •

- Election of directors.

-Ratification - •

- Ratification of the appointment of Deloitte & Touche LLP as auditors.

-Such - •

- A shareholder proposal regarding expensing stock option grants.

- •

- Such other matters as may properly come before the meeting.

The record date for shareholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof is March 15, 2002.

17, 2003.

Admittance to the meeting will be limited to shareholders. Shareholders who plan to attend are requested to so indicate by marking the appropriate space on the enclosed proxy card or following the telephonic or Internet instructions. If you are a shareholder of record or you are a participant in any of FPL Group, Inc.'s Employee Thrift Plans an admission ticket is included as part of your proxy card. You will need your admission ticket, as well as a form of personal identification, to attend the annual meeting. Shareholders whose shares are held in street name (the name of a broker, trust, bank or other nominee) should bring with them a legal proxy or a recent brokerage statement or letter from the street name holder confirming their beneficial ownership of shares.

PLEASE MARK, DATE, SIGN, AND RETURN THE ENCLOSED PROXY CARD PROMPTLY SO THAT

YOUR SHARES CAN BE VOTED, REGARDLESS OF WHETHER YOU EXPECT TO ATTEND THE

MEETING. ALTERNATIVELY, YOU MAY CAST YOUR VOTE BY TELEPHONE OR ELECTRONICALLY BY

FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD. IF YOU ATTEND, YOU MAY WITHDRAW

YOUR PROXY AND VOTE IN PERSON.

Please mark, date, sign, and return the enclosed proxy card promptly so that your shares can be voted, regardless of whether you expect to attend the meeting. Alternatively, you may cast your vote by telephone or electronically by following the instructions on your proxy card. If you attend, you may withdraw your proxy and vote in person.

By order of the Board of Directors.

/s/

Dennis P. Coyle

DENNIS P. COYLE

General Counsel and Secretary

Juno Beach, Florida

April 19, 2002

FPL GROUP, INC.

ANNUAL MEETING OF SHAREHOLDERS

MAY 24, 2002

PROXY STATEMENT

ANNUAL MEETING

Annual Meeting of Shareholders

May 23, 2003

Proxy Statement

Annual Meeting

The Annual Meeting of Shareholders of FPL Group, Inc. ("FPL Group" or the "Corporation""Company") will be held at 10:00 a.m. on Friday, May 24, 2002.23, 2003. The enclosed proxy is solicited by your Board of Directors, who urge you to respond in the belief that every shareholder, regardless of the number of shares held, should be represented at the Annual Meeting.

Whether or not you expect to be present at the meeting, please mark, sign, and date the enclosed proxy card and return it in the enclosed envelope. Alternatively, you may cast your vote by telephone or electronically by following the instructions on your proxy card. Please note that there are separate arrangements for using electronic voting depending on whether your shares are registered in your name or in the name of a brokerage firm or bank. You should check the proxy card or voting instructions forwarded by your broker, bank or other holder of record to see which options are available. If voting by telephone you should dial the toll-free number indicated on the proxy card; you will then be prompted to enter the control number printed on your proxy card and to follow subsequent instructions. Any shareholder giving a proxy may revoke it at any time before it is voted at the meeting by delivering to the CorporationCompany written notice of revocation or a proxy bearing a later date, or by attending the meeting in person and casting a ballot. You may also change your vote by telephone or electronically. You may change your vote by using any one of these methods regardless of the procedure used to cast your previous vote. Votes cast in person or by proxy will be tabulated by the inspectors of election appointed by the Board of Directors.

The shares represented by your proxy will be voted in accordance with the specifications made on your proxy. Unless otherwise directed, such shares will be voted:

-For

- •

- For the election as directors of the nominees named in this proxy statement.

-For - •

- For the ratification of the appointment of Deloitte & Touche LLP as auditors.

-In - •

- Against the shareholder proposal relating to expensing stock option grants.

- •

- In accordance with the best judgment of the persons acting under the proxy concerning other matters that are properly brought before the meeting and at any adjournment or postponement thereof.

Shareholders of record at the close of business on March 15, 2002,17, 2003, are entitled to notice of, and to vote at, the meeting. Each share of Common Stock, $.01 par value, of the CorporationCompany is entitled to one vote. At the close of business on March 15, 2002,17, 2003, the CorporationCompany had 175,944,248183,234,174 shares of Common Stock outstanding and entitled to vote. The CorporationCompany anticipates first sending this proxy statement and the enclosed proxy card to shareholders on or about April 19, 2002.

10, 2003.

In determining the presence of a quorum at the Annual Meeting, abstentions are counted and broker non-votes are not counted. The current Florida Business Corporation Act (the "Act") provides that directors are elected by a plurality of the votes cast and all other matters are approved if the votes cast in favor of the action exceed the votes cast against the action (unless the matter is one for which the Act or the articles of incorporation require a greater vote). Therefore, under the Act, abstentions and broker non-votes have no legal effect on whether a matter is approved. However, FPL Group's Bylaws, which

1

were adopted prior to the current Act and remain in effect, provide that any matter, including the election of directors, is to be approved by the affirmative vote of a majority of the total number of shares represented at the meeting and entitled to vote on such matter (unless the matter is one for which the Act

1

BUSINESS OF THE MEETING

PROPOSAL

Proposal 1: ELECTION OF DIRECTORS

Election of Directors

Listed below are the eleven nominees for election as directors, their principal occupations, and certain other information regarding them. Unless otherwise noted, each director has held his or her present position continuously for five years or more and his or her employment history is uninterrupted. Directors serve until the next Annual Meeting of Shareholders or until their respective successors are elected and qualified. Unless you specify otherwise in your proxy, it will be voted for the election of the listed nominees.

| H. | |

| Sherry S. | |

| Robert M. | |

2

| J. | |

| James L. Camaren Mr. | |

| Alexander W. |

| Paul J. | |

3

| Lewis Hay III Mr. Hay, | |

| Frederic V. | |

| Paul R. | |

| Frank G. Zarb Mr. Zarb, 68, is chairman of Frank Zarb Associates, LLC, a consulting firm to the financial industry, and a managing director of Hellman & Friedman, LLC, a private equity investment firm. He served as the chairman and chief executive officer of the National Association of Securities Dealers, Inc. from February 1997 until October 2000 and The Nasdaq Stock Market, Inc. from February 1997 until January 2001 and as chairman of those organizations until September 2001. From 1994 to January 1997 he was chairman, president and chief executive officer of Alexander & Alexander Services, Inc., a worldwide insurance brokerage and professional services consulting firm. He served in senior posts with seven U.S. Presidents, including the Federal Energy Administration (Energy Czar) in the Ford Administration. He is a director of American International Group, Inc. Mr. Zarb has been a director of FPL Group since August 2002. |

The Board of Directors recommends a vote "FOR" THE ELECTION OF ALL NOMINEES.

the election of all nominees.

4

PROPOSAL

Proposal 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

UponRatification of Appointment of Independent Auditors

In accordance with the recommendationprovisions of the Sarbanes-Oxley Act of 2002 ("SOA"), the Audit Committee of the Board now appoints the Company's independent auditors. It has appointed the certified public accounting firm of Deloitte & Touche LLP as independent public accountants to audit the accounts of FPL Group and its subsidiaries for the fiscal year ending December 31, 2002, and

to perform such other services as may be required of them.2003. If the shareholders do not ratify the appointment, it will be reconsidered by the Audit CommitteeCommittee.

In accordance with the requirements of SOA and the Boardrevised Charter of Directors.

the Audit Committee, effective May 1, 2003, all audit and audit-related work performed by Deloitte & Touche LLP is approved in advance by the Audit Committee, including the fees payable to them for such work. In addition, and also in conformity with SOA and with its Charter as revised effective May 1, 2003, the Audit Committee approves all non-audit work performed by Deloitte & Touche LLP in advance of the commencement of such work or, in cases which meet the de minimus exception in SOA, prior to completion of the audit. The Audit Committee has delegated to the chairman of the committee the right to approve audit, audit-related and non-audit work, within certain limitations, between meetings of the Audit Committee, provided any such decision is presented to the Audit Committee at its next scheduled meeting.

Representatives of Deloitte & Touche LLP will be present at the 20022003 Annual Meeting and will have an opportunity to make a statement and to respond to appropriate questions raised at the meeting.

Audit Fees

The aggregate fees billed

For the years ended December 31, 2002 and 2001, professional services were performed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, Deloitte & Touche), which includes Deloitte Consulting.

Audit and audit-related fees aggregated $1,691,000 and $1,973,000 for professional services renderedthe years ended December 31, 2002 and 2001, respectively and were composed of the following:

Audit Fees

The aggregate fees billed for the audit of FPL Group's annual consolidated financial statements for the fiscal yearyears ended December 31, 2002 and 2001 and for the reviews of the financial statements included in FPL Group's Quarterly Reports on Form 10-Q for thatthese fiscal yearyears were $1,013,000.

Financial Information Systems Design$1,390,000 and Implementation$1,158,000, respectively.

Audit-Related Fees

The aggregate fees billed by Deloitte & Touche for professionalaudit-related services

rendered for information technology services relating to financial information

systems design and implementation for the fiscal yearyears ended December 31, 2002 and 2001 were $3,220,000, all of which were billed by Deloitte Consulting. Deloitte &

Touche has recently announced its intent to separate Deloitte Consulting from

the firm.

All Other Fees

The aggregate$301,000 and $815,000, respectively. These fees billed by Deloitte & Touche for services rendered to the

Corporation other than the services described above under Audit Fees and

Financial Information Systems Design and Implementation Fees, for the fiscal

year ended December 31, 2001, were $2,227,000, including audit related services

of approximately $1,001,000, merger-related services of $1,116,000 and non-audit

services of $110,000. These amounts include $1,323,000 of fees billed by

Deloitte Consulting. Audit related services generally include fees for comfort

letters and consentsprimarily related to registration statements, audits of employee benefit plans, due diligence pertaining to acquisitions and consultation on accounting standards orand on transactions. Audit-related fees include $206,000 of fees billed by Deloitte Consulting for the year ended December 31, 2001.

Tax Fees

The aggregate fees billed for tax services for the fiscal years ended December 31, 2002 and 2001 were $1,194,000 and $83,000, respectively. These fees primarily related to tax compliance and planning services.

All Other Fees

The aggregate fees for services not included above were $1,773,000 and $4,397,000, respectively, for the fiscal years ended December 31, 2002 and 2001. The fees primarily related to integrated supply chain systems implementation and employee benefit consulting, and 2001 also includes merger-related services. All other fees include $1,334,000 and $4,336,000 of fees billed by Deloitte Consulting for the years ended December 31, 2002 and 2001, respectively.

The Audit Committee has considered whether the provision ofdetermined that the non-audit services isprovided by Deloitte & Touche during 2002 and 2001 were compatible with maintaining Deloittethat firm's independence.

The Board of Directors recommends a vote "FOR" ratification.

5

Proposal 3: Expensing Stock Option Grants

The United Brotherhood of Carpenters and Joiners of America, 101 Constitution Avenue, N.W., Washington, DC 20001, is the beneficial owner of approximately 300 shares of FPL Group's Common Stock and submits the following proposed resolution and supporting statement:

Resolved, that the shareholders of FPL Group, Inc. ("Company") hereby request that the Company's Board of Directors establish a policy of expensing in the Company's annual income statement the costs of all future stock options issued by the Company.

Current accounting rules give companies the choice of reporting stock option expenses annually in the company income statement or as a footnote in the annual report (See: Financial Accounting Standards Board Statement 123). Most companies, including ours, report the cost of stock options as a footnote in the annual report, rather than include the option costs in determining operating income. We believe that expensing stock options would more accurately reflect a company's operational earnings.

Stock options are an important component of our Company's executive compensation program. Options have replaced salary and bonuses as the most significant element of executive pay packages at numerous companies. The lack of option expensing can promote excessive use of options in a company's compensation plans, obscure and understate the cost of executive compensation and promote the pursuit of corporate strategies designed to promote short-term stock price rather than long-term corporate value.

A recent report issued by Standard & Touche LLP's independence.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" RATIFICATION.

5

Warren Buffett wrote in aNew York Times Op-Ed piece on July 24, 2002:

There is a crisis of confidence today about corporate earnings reports and the credibility of chief executives. And it's justified.

For many years, I've had little confidence in the earnings numbers reported by most corporations. I'm not talking about Enron and WorldCom—examples of outright crookedness. Rather, I am referring to the legal, but improper, accounting methods used by chief executives to inflate reported earnings...

Options are a huge cost for many corporations and a huge benefit to executives. No wonder, then, that they have fought ferociously to avoid making a charge against their earnings. Without blushing, almost all C.E.O.'s have told their shareholders that options are cost-free...

When a company gives something of value to its employees in return for their services, it is clearly a compensation expense. And if expenses don't belong in the earnings statement, where in the world do they belong?

Many companies have responded to investors' concerns about their failure to expense stock options. In recent months, more than 100 companies, including such prominent ones as Coca Cola, Washington Post, and General Electric, have decided to expense stock options in order to provide their shareholders more accurate financial statements. Our Company has yet to act. We urge your support.

6

The Board of Directors has carefully considered the proposal submitted by The United Brotherhood of Carpenters and Joiners of America and does not believe that it is in the best interests of our shareholders to record stock option expense in FPL Group's income statement at this time.

There is considerable ongoing debate regarding accounting for stock options. This debate may well be resolved by the accounting standard setters in the relatively near future. We believe that it would be premature for FPL Group to change its accounting until this issue is resolved. We believe that FPL Group would be placed at a competitive disadvantage if it were to begin recognizing stock option expense in its income statement at a time when most of FPL Group's peer companies do not recognize expense for stock options in their income statements, and that FPL Group shareholders would be disadvantaged by making it more difficult for investors to compare FPL Group's performance to that of its peers. FPL Group's reported earnings would be comparatively lower than the reported earnings of peer companies that do not expense stock options. If the current debate results in new accounting rules that require all companies to expense stock options, FPL Group will, of course, comply.

The Board of Directors believes employee ownership of the Company's Common Stock serves the interest of all shareholders as a means of promoting focus on the long-term increase in shareholder value. In 2002, options at market prices were granted to over 783 people at all levels of the Company, not just senior executives. Option grants are just one element of the Company's program to attract, motivate, and retain the talent that is critical to its success. Moreover, we believe that the use of stock option grants at FPL Group has always been modest and appropriate. The dilutive effect of these options has always been reflected in the Company's weighted-average shares outstanding that is used for purposes of computing diluted earnings per share in accordance with generally accepted accounting principles. During the past three fiscal years, stock options (net of cancellations) have diluted earnings per share by1/10 of 1% in 2000,6/100 of 1% in 2001 and9/100 of 1% in 2002.

Current accounting rules give companies the choice of accounting for stock options using the intrinsic value method prescribed by Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees," which generally results in recording no expense for stock option awards, or the fair value method prescribed by Statement of Financial Accounting Standards No. 123, "Accounting for Stock Compensation," ("SFAS No. 123"), which generally results in expense recognition. Accounting rules further require that the impact of the fair value method be disclosed in the footnotes to the financial statements if the intrinsic value method is used. FPL Group is in full compliance with current accounting rules.

Most public companies, including FPL Group, account for employee stock-based compensation, including stock options, using the intrinsic value method. The "intrinsic value" of the option is the amount by which the quoted market price of the stock exceeds the exercise price of the option on the date of grant. Generally, option awards have zero intrinsic value on the date of grant as the exercise price is set to be equal to the market price of the stock on that date. In addition, all of the options granted to the employees of FPL Group are subject to vesting periods and cannot be exercised on the grant date. Therefore, the Board of Directors believes the "intrinsic value" method provides both a transparent and accurate picture of the Company's earnings.

The fair value method computes compensation expense based on the fair value of the option at the date of grant. "Fair value" is determined using an option-pricing model that takes into account multiple factors in estimating value. However, no uniform or conventional methodology is mandated for computing fair value, and the provisions of SFAS No. 123 related to fair value calculation are subject to wide interpretation which can have a material impact on the calculation of expense.

The Board of Directors believes it is generally in the best interest of shareholders for the Company to follow the most widely used industry practice when given a choice under accounting rules, and to the extent there is uncertainty and debate, to await consensus and/or direction by the accounting authorities prior to

7

implementing any material change. The uncertainties associated with a current adoption of SFAS No. 123 may lead to financial statements that are not comparable with FPL Group's industry peers. Consequently, the Board of Directors has determined that the intrinsic value method remains the preferable choice, both because it is currently the most widely used standard and because it provides complete information to evaluate the Company with or without the inclusion of stock options as an expense. While an estimated value of expense for stock options is not included in the Company's consolidated statements of income, the impact of the potential expense is clearly disclosed in the notes to the consolidated financial statements, thus giving investors information necessary to evaluate the Company's earnings under the alternate methodology. As reflected in note 1 of the notes to our consolidated financial statements, use of the fair value method would have had an estimated earnings impact of $0.04 per share in fiscal 2002.

We share the desire to have transparent and accurate accounting policies implemented in a prudent manner with full and complete information as it pertains to this issue. We believe the best way to accomplish this objective at this time is to retain the current accounting policy with respect to stock options and await consensus and clarity on whether, and if so how, to expense stock options.

The Board of Directors recommends a vote "AGAINST" the proposal to expense stock options.

8

INFORMATION ABOUT THE CORPORATIONCOMPANY AND MANAGEMENT

PERFORMANCE GRAPHS

Performance Graphs

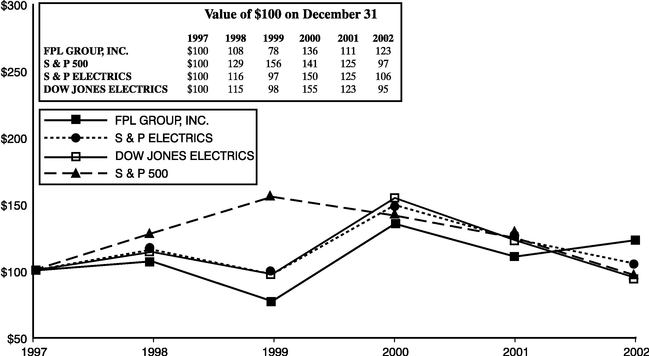

The graph below compares the cumulative total returns, including reinvestment of dividends, of FPL Group Common Stock with the companies in the Standard & Poor's 500 Index (S&P 500), the Standard & Poor's Electric Companies Index (S&P Electrics) and the Dow Jones US Electric Utilities Index (Dow Jones Electrics). The comparison covers the five years ended December 31, 2001,2002, and is based on an assumed $100 investment on December 31, 1996,1997, in each of the S&P 500, the S&P Electrics, the Dow Jones Electrics and FPL Group Common Stock. The S&P Electrics is based on the performance of 2724 companies; the Dow Jones Electrics is based on the performance of 6660 companies. The S&P Electrics is more heavily weighted toward companies engaged in the traditional state-regulated electric utility business. The Dow Jones Electrics, which includes all of the companies included in the S&P Electrics, also includes a number of companies that are exclusively or primarily engaged in the independent power production business. FPL Group is primarily engaged in the traditional electric utility business, but is increasingly engaged in the independent power production business as well. Therefore, both indexes have been selected for comparison purposes. FPL Group is included in all three indexes.

TOTAL RETURN FOR THE

FIVE YEARS ENDED DECEMBER 31, 2001

EDGAR REPRESENTATION OF DATA POINTS USED IN PRINTED GRAPHIC

Value of $100 on

Total Return for the

Five Years Ended December 31,

FPL GROUP S & P ELECTRICS DOW JONES ELECTRICS S & P 500

1996 100 100 100 100

1997 134 126 129 133

1998 144 146 148 171

1999 104 118 126 208

2000 182 180 200 189

2002 149 160 159 166

6

In 1990, FPL Group announced its intention to focus on its core utility and

other energy-related businesses and to exit businesses not related to its core

strengths. Since then, FPL Group has realigned its senior management team,

reorganized Florida Power & Light Company, established FPL Energy, LLC, and

divested essentially all its non-energy-related businesses. The graph below

shows the cumulative total return, including reinvestment of dividends, of FPL

Group 2002

9

Common Stock since these fundamental changes were made. It covers the ten

years ended December 31, 2001,Ownership of Management and assumes the investment of $100 on

December 31, 1991.

TOTAL RETURN FOR THE

TEN YEARS ENDED DECEMBER 31, 2001

EDGAR REPRESENTATION OF DATA POINTS USED IN PRINTED GRAPHIC

Value of $100 on December 31,

FPL GROUP S & P ELECTRICS DOW JONES ELECTRICS S & P 500

1991 100 100 100 100

1992 105 106 107 108

1993 121 119 120 118

1994 115 104 105 120

1995 159 136 137 165

1996 164 136 140 203

1997 220 171 181 271

1998 237 198 208 348

1999 171 159 177 421

2000 299 245 281 383

2001 244 217 223 338

7

COMMON STOCK OWNERSHIP OF MANAGEMENT AND OTHERS

Others

The following table indicates how much FPL Group Common Stock is beneficially owned by (a) each person known by FPL Group to own 5% or more of the Common Stock, (b) each of FPL Group's directors and each executive officer named in the Summary Compensation Table, and (c) the directors and all FPL Group executive officers as a group.

| Principal Shareholders: | Number of Shares(a) | |

|---|---|---|

| Fidelity Management Trust 82 Devonshire Street Boston, Massachusetts 02109 | 14,728,851(b) | |

| Wellington Management Company, 75 State Street Boston, Massachusetts 02109 | 15,283,356(c) | |

| Directors and Executive Officers: | ||

| H. Jesse | 13,488(d)(e)(g) | |

| Sherry S. | 8,636(d)(g) | |

| Robert M. Beall, | 9,483(e)(g) | |

| J. Hyatt Brown | 17,445(e)(g)(i) | |

| James L. | 5,400(g) | |

| Armando M. | 17,346(d)(e)(g)(j) | |

| Dennis P. | 190,341(f)(g)(h)(i) | |

| Moray P. Dewhurst | 75,116(d)(f)(g)(h) | |

| Willard D. | 9,634(e)(g)(j) | |

| Alexander W. Dreyfoos, | 13,838(d)(g) | |

| Paul J. | 294,258(d)(f)(g)(h) | |

| Lewis Hay | 256,026(d)(f)(g)(h) | |

| Frederic V. | 8,426(e)(g) | |

| James L. Robo | 40,223(f)(g)(h) | |

| Paul R. | 10,712(d)(e)(g) | |

| Frank G. Zarb | 2,900(g) | |

| All directors and executive officers as a | 1,365,067(d)(e)(f)(g)(h)(i)(k) |

- (a)

- Information is as of February

28, 2002,13, 2003, except as indicated. Unless otherwise indicated, each person has sole voting and sole investment power. - (b)

- Represents

8.9%8.1% of the Common Stock outstanding; shares held as Trustee under the Florida Power & Light Company Master Thrift Plan Trust. The Trustee disclaims beneficial ownership of such securities. Shares are voted by the Trustee in accordance with instructions of the participants to whose accounts such shares are allocated, and a proportionate number of shares which are held in the plans but not yet allocated to participants are voted in accordance with such instructions. Leveraged ESOP shares held in the plans which have been allocated to participants' accounts, but for which voting instructions are not received, are voted by the Trustee in the same proportions as those shares which have been voted by participants. - (c)

- Represents

9.3%8.4% of the Common Stock outstanding. This information has been derived from Schedule 13G/A of Wellington Management Company, LLP ("WMC"), filed with the Securities and Exchange Commission on February 12,2002.2003. All shares are owned of record by clients of WMC, which reported shared voting power over8,633,7408,308,439 shares and shared dispositive power over16,377,90715,283,356 shares. - (d)

- Includes

15,000; 18,750; 32,500; 25,000;4,154; 9,859; 5,353; 6,238; 72,287; 1,600; 217; and16,0004,436 share units for Messrs. Arnelle, Codina, Dewhurst, Dreyfoos, Evanson, Hay and Tregurtha, and Mrs. Barrat, respectively, and a total of 147,235 share units for all directors and executive officers as a group, under deferred compensation plans. Such units have no voting rights. - (e)

- Includes 4,947; 2,963; 4,095; 2,487; 5,734; 4,426; and 4,495 share units for Messrs. Arnelle, Beall, Brown, Codina, Dover, Malek and Tregurtha, respectively, and a total of 29,147 share units for all

10

directors and executive officers as a group, granted in connection with the termination of the FPL Group, Inc. Non-Employee Director Retirement Plan. Such units have no voting rights and are subject to forfeiture upon retirement from the Board before age 65.

- (f)

- Includes 5,861; 523; 7,855; 2,239; and 88 phantom shares for Messrs. Coyle, Dewhurst, Evanson, Hay and Robo, respectively, and a total of 20,803 phantom shares for all directors and executive officers as a group, credited to a Supplemental Matching Contribution Account under the Supplemental Executive Retirement Plan. Phantom shares have no voting rights.

- (g)

- Includes 12,500; 23,334; 15,625; 25,416; and 15,000 shares of restricted stock held by Messrs. Coyle, Dewhurst, Evanson, Hay,

KelleherandOlivera,Robo, respectively;2,3003,000 shares of restricted stock held by each of Messrs. Arnelle, Beall, Brown, Codina, Dover, Malek and Tregurtha;2,5003,200 shares of restricted stock held by each of Mrs. Barrat and Mr. Dreyfoos;and a total of 191,850900 shares of restricted stock held by8each of Messrs. Camaren and Zarb; and a total of 188,411 shares of restricted stock held by all directors and executive officers as a group, as to which each person has voting power, but not investment power. (e) - (h)

- Includes options held by Messrs.

Broadhead,Coyle, Dewhurst, Evanson, HayKelleher,andOliveraRobo, to purchase250,000; 50,000; 75,000; 75,000; 50,000;116,667; 41,667; 175,000; 191,667; and 25,000 shares, respectively, and options to purchase a total of525,000745,003 shares for all directors and executive officers as a group.(f) - (i)

- Includes 350 shares owned by children of Mr. Brown who are over 21 years of age, as to which Mr. Brown disclaims beneficial ownership;

and25 shares owned by Mr. Coyle's wife, as to which Mr. Coyle disclaims beneficialownership. (g)ownership; and 20,610 shares owned by Coyle Holdings Limited Partnership, as to which Mr. Coyle disclaims beneficial ownership except to the extent of his pecuniary interest therein. - (j)

- Messrs. Codina and Dover are retiring as FPL Group directors in May 2003.

- (k)

- Less than 1% of the Common Stock outstanding.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) Beneficial Ownership Reporting Compliance

The Corporation'sCompany's directors and executive officers are required to file initial reports of ownership and reports of changes of ownership of Common Stock with the Securities and Exchange Commission. Based upon a review of these filings and written representations from the directors and executive officers, all required filings were timely made in 20012002 except for the late filing of a Form 3 for Mr. Camaren.

Director Independence; Certain Relationships and oneRelated Transactions

The Board of Directors has conducted a review regarding the independence of each of its members from management of the Company under the criteria legislated by the Sarbanes-Oxley Act of 2002 ("SOA") and proposed in August 2002 and revised in March 2003 by the New York Stock Exchange (proposed Section 303A of the New York Stock Exchange Listed Company Manual). The proposed New York Stock Exchange criteria would also require that the Compensation Committee, Governance Committee and Audit Committee, whose members are all non-employee directors, consist entirely of independent directors, and enhance existing, additional independence requirements for Audit Committee members.

Based on this review, the Board determined that all of the non-employee directors are independent under SOA and proposed Section 303A. Specifically, the Board determined that of the eleven current non-employee directors (including the nine nominated for election at the annual meeting), eight did not have a direct or indirect relationship with the Company outside of their status as a director or shareholder of the Company, and three have an indirect relationship which is described below and which, in each case, the Board determined is not a material relationship which interferes with their independence. The indirect relationships of Mrs. Barrat and Mr. Tregurtha are not required to be disclosed under applicable SEC rules, but the Company is providing this information to assist shareholders in understanding the Board's evaluation of director independence.

Mrs. Barrat is Chairman and Chief Executive Officer of Northern Trust Bank of California N.A. The Northern Trust Company, the parent company of Northern Trust Bank of California, has an ongoing credit, treasury management and trust custody relationship with FPL Group and its subsidiaries. In 2002, The Northern Trust Company provided $40 million in credit facilities to FPL Group subsidiaries (out of a

11

total of $3.1 billion in credit facilities), earned $236,000 in treasury management revenue from Florida Power & Light Company and earned $370,000 in trust custody revenue from an indirect subsidiary of FPL Group. In determining Mrs. Barrat's independence, the Board considered, among other things, that Mrs. Barrat's position is not with the companies that have the business relationships with the Company, that her compensation from Northern Trust Bank of California is not based upon or affected by the revenue or net income received by The Northern Trust Company from FPL Group and its subsidiaries, and that the revenue received in 2002 from FPL Group subsidiaries represented less than 1% of the total revenue of The Northern Trust Company.

Mr. Malek is a managing partner in TC Equity Partners IV, LLC, which is the general partner of Thayer Equity Investors IV, L.P., a private-equity investment fund. Iconixx Corporation is a portfolio investment of Thayer Equity Investors IV, L.P., which owns a 98% interest in Iconixx. In 2002, Florida Power & Light Company entered into an agreement with Iconixx to enhance a transaction involving 153 phantom shares credited asmanagement system in the Energy Marketing and Trading division, and paid Iconixx $1,027,650 in 2002 in connection with that agreement. Also in 2002, FPL Energy Power Marketing, Inc. ("PMI"), an indirect subsidiary of July 30, 2001 underthe Company, entered into an agreement with Iconixx to integrate data from external sources into the PMI data warehouse, and paid $253,100 in 2002 in connection with that agreement. Both Iconixx agreements ended in 2002. In determining Mr. Malek's independence, the Board considered, among other things, that Mr. Malek's position is not with the company that had the business relationships with the Company, that his compensation from TC Equity Partners IV, LLC is not based upon or affected by the revenue or net income received by Iconixx from FPL Group and its subsidiaries, and that the revenue Iconixx received from the FPL Group Inc. Supplemental Executive Retirement Plansubsidiaries was not paid to or consolidated into the results of Thayer Equity Investors IV and represents less than 1% of the total revenue of Thayer Equity Investors IV, L.P.

Mr. Tregurtha is the chairman and chief executive officer and a substantial equity owner of Moran Transportation Company. In October 1998, Florida Power & Light Company entered into a 5-year contract with Petroleum Transport Corporation ("PTC"), an indirect subsidiary of Moran Transportation Company, to provide inland fuel oil barge services to the Sanford and Port Canaveral power generation plants. The contract was awarded as a result of a competitive bidding process. In 2002, Florida Power & Light Company paid PTC $4,504,755 for services under the contract, consisting of $1,727,135 for barging services and $2,777,620 as an early termination payment for Florida Power & Light Company to terminate the Sanford portion of the contract in connection with the reconstruction of that plant and the switching of its fuel from oil to natural gas. The termination payment was made pursuant to the contract to compensate PTC for losses sustained in disposing of specially ordered equipment. The remaining portion of the contract expires on September 20, 2003, and the estimated payment for barge services to Port Canaveral in 2003 is $1,000,000. In determining Mr. Tregurtha's independence, the Board considered, among other things, that the contract was awarded pursuant to a Supplemental

Matching Contribution Account,competitive bidding process, that his compensation from Moran Transportation Company and its subsidiaries is not based upon or affected by the revenue or net income received by PTC from Florida Power & Light Company, and the revenue received from Florida Power & Light Company represents less than 1% of the total revenue of Moran Transportation Company and its subsidiaries.

Litigation

In January 2002, Roy Oorbeek and Richard Berman filed suit in the U.S. District Court for Mr. Stall.

DIRECTOR MEETINGS AND COMMITTEES

the Southern District of Florida against FPL Group (as an individual and nominal defendant); all its current directors (except James L. Camaren and Frank G. Zarb); certain former directors; and certain current and former officers of FPL Group and Florida Power & Light Company, including Lewis Hay III, Dennis P. Coyle, and Paul J. Evanson. The lawsuit alleges that the proxy statements relating to shareholder approval of FPL Group's Long Term Incentive Plan (LTIP) and FPL Group's proposed, but unconsummated, merger with Entergy Corporation (Entergy) were false and misleading because they did not affirmatively state that payments made to certain officers under FPL Group's LTIP upon shareholder approval of the merger would be retained by the officers even if the merger with Entergy was not consummated and did not state

12

that under some circumstances payments made pursuant to FPL Group's LTIP might not be deductible by FPL Group for federal income tax purposes. It also alleges that FPL Group's LTIP required either consummation of the merger as a condition to the payments or the return of the payments if the transaction did not close, and that the actions of the director defendants in approving the proxy statements, causing the payments to be made, and failing to demand their return constitute corporate waste. The plaintiffs seek to have the shareholder votes approving FPL Group's LTIP and the merger declared null and void, the return to FPL Group of $62 million of payments received by the officers, compensatory damages of $92 million (including the $62 million of payments received by the officers) from all defendants (except FPL Group) and attorneys' fees. FPL Group's board of directors had previously established a special committee to investigate a demand by another shareholder that the board take action to obtain the return of the payments made to the officers and expanded that investigation to include the allegations in the Oorbeek and Berman complaint.

In March 2002, William M. Klein, by Stephen S. Klein under power of attorney, on behalf of himself and all others similarly situated, filed suit in the U.S. District Court for the Southern District of Florida against FPL Group (as nominal defendant); all its current directors (except James L. Camaren and Frank G. Zarb); certain former directors; and certain current and former officers of FPL Group and Florida Power & Light Company, including Paul J. Evanson, Lewis Hay III and Dennis P. Coyle. The lawsuit alleges that the payments made to certain officers under FPL Group's LTIP upon shareholder approval of the proposed merger with Entergy were improper and constituted breaches of fiduciary duties by the individual defendants because the LTIP required consummation of the merger as a condition to the payments. The plaintiff seeks the return to FPL Group of the payments received by the officers ($62 million); contribution, restitution and/or damages from the individual defendants; and attorneys' fees. These allegations also were referred to the special committee of FPL Group's board of directors investigating the allegations in the Oorbeek and Berman lawsuit.

In August 2002, the special committee filed under seal with the court its report of its investigation. The report concluded that pursuit of the claims identified by the plaintiffs in the Oorbeek and Berman and the Klein lawsuits is not in the best interest of FPL Group or its shareholders generally, and recommended that FPL Group seek dismissal of the lawsuits. After reviewing the special committee's report, FPL Group's board of directors (with only independent directors participating) concluded likewise. In September 2002, FPL Group, as nominal defendant, filed the special committee's report in the public docket and filed with the court a Statement of Position setting forth the special committee's and the board's conclusions and authorizing the filing of a motion to dismiss. The Statement of Position also reported that during the course of the special committee's investigation of the allegations in the lawsuits a separate question arose concerning the interpretation of the provisions of the LTIP pursuant to which the payments to eight senior officers were calculated. The board, the affected officers (two of whom have retired from FPL Group), and their respective legal counsel are discussing resolution of the issue. Any change from the original interpretation could result in a repayment to FPL Group of up to approximately $9 million.

In February 2003, Donald E. and Judith B. Phillips filed suit in the U.S. District Court for the Southern District of Florida against FPL Group (as nominal defendant); all its current directors (except James L. Camaren and Frank G. Zarb); certain former directors; and certain current and former officers of FPL Group and Florida Power & Light Company, including Paul J. Evanson, Lewis Hay III and Dennis P. Coyle. The allegations in, and relief sought by, the lawsuit are similar to those in the Oorbeeck and Berman lawsuits.

Director Meetings and Committees

The Board of Directors met tennine times in 2001.2002. Each director, except Mr. Brown, attended at least 75% of the total number of Board meetings and meetings of the committees on which he or she served. Mr. Brown attended 15 of 21 (71%) of such meetings.

13

FPL Group's Audit Committee, comprised of Mrs. Barrat and Messrs. Arnelle, Beall (Chair), Brown, Dover, Dreyfoos and DreyfoosMalek, met eighteleven times in 2001.2002. An updated written charter for the Committee was approved by the Board in May 2000. As set forth in more detail in the charter, the Audit Committee assistsassisted the Board in monitoring the financial reporting process, the internal control structure and the independence and performance of the internal audit department and the independent public accountants. During the year,2002, the Board examined the composition of the Audit Committee in light of the adoption by theexisting New York Stock Exchange of new rules governing audit committees. Based upon this examination, the Board confirmed that all members of the Audit Committee are "independent" within the meaning of the Exchange's existing rules.

More recently, the Board has reviewed and made the determinations required by the Sarbanes-Oxley Act of 2002 ("SOA"), Securities and Exchange Commission ("SEC") rules and proposed Section 303A of the New York Stock Exchange Listing Manual, regarding the independence of the members of the Audit Committee.

In March 2003, the Audit Committee developed an updated charter for the Committee, which was approved by the Board March 21, 2003 and effective May 1, 2003. The complete text of the new rules.

charter, which reflects standards set forth in SOA, in new and proposed SEC regulations and in proposed New York Stock Exchange corporate governance rules, is reproduced in an appendix to this proxy statement. As set forth in more detail in the new charter, the Audit Committee has the authority to appoint or replace the Company's independent auditor, and approves all permitted services to be performed by the independent auditor. The Audit Committee assists the Board in monitoring the integrity of the financial statements, compliance with legal and regulatory requirements, the system of disclosure controls and internal controls and the independence and performance of the internal audit department and the independent public accountants.

The Compensation Committee, comprised of Messrs. Arnelle, Beall, Brown (Chair), Camaren, Codina, Tregurtha, and Tregurtha,Zarb, met sevenfive times in 2001.2002. Messrs. Camaren and Zarb were appointed to the Committee in December 2002. Its functions include reviewing and approving the executive compensation program for FPL Group and its subsidiaries; setting performance targets; assessing executive performance; making grants of salary, annual incentive compensation, and long-term incentive compensation; and approving certain employment agreements.

The Executive Committee, comprised of Messrs. Broadhead (Chair), Beall, Brown,

Codina, Malek, and Tregurtha, met three times in 2001. It functioned as the

Nominating Committee through 2001. Starting in 2002 that responsibility has been

assumed by the Governance Committee, which is comprised of Mrs. Barrat and Messrs. Codina (Chair), Dover, Dreyfoos, Tregurtha and Tregurtha. As such, itZarb, met five times in 2002. Mr. Zarb was appointed to the Committee in December 2002. It is responsible for identifying and evaluating potential nominees for election to the Board and recommends candidates for all directorships to be filled by the shareholders or the Board. The Committee will consider potential nominees recommended by any shareholder entitled to vote in elections of directors. Potential nominees must be submitted in writing to the Corporate Secretary, FPL Group, Inc., P.O. Box 14000, 700 Universe Boulevard, Juno Beach, Florida 33408-0420 and must be received not later than 90 days in advance of the Annual Meeting of Shareholders.

9

DIRECTOR COMPENSATION

Director Compensation

Directors of FPL Group who are salaried employees of FPL Group or any of its subsidiaries do not receive any additional compensation for serving as a director or committee member. Non-employee directors of FPL Group receive an annual retainer of $32,000 plus 700 shares of restricted Common Stock. Non-employee committee chairpersons receive an additional annual retainer of $4,000. A fee of $1,300 is paid to non-employee directors for each Board or committee meeting attended. Newly-elected non-employee directors are awarded 200 shares of restricted Common Stock when they join the Board.

Effective November 1, 1996, FPL Group's Non-Employee Director Retirement Plan was terminated. Retirement benefits of non-employee directors in office in 1996 and not retiring at or prior to the 1997 annual shareholders' meeting were converted to share units of FPL Group Common Stock. Such directors

14

will be entitled to payment of the then current value of these share units upon ending service as a Board member at or after age 65. Upon his retirement from the Board

in May 2001, Marshall Criser received $425,457, which he elected to receive in

the form of an annuity, for the value of his share units.

Non-employee directors are covered by travel and accident insurance while on FPL Group business. Total premiums attributable to such directors amounted to $2,888$2,363 for 2001.

AUDIT COMMITTEE REPORT

2002.

Audit Committee Report

The Audit Committee submits the following report for 2001:

In accordance with2002:

The Audit Committee of the Board (Committee) consists of six independent directors. The responsibilities of the Committee are set forth in its written charter, which has been adopted by the Board of Directors (Board),. A copy of that charter was reproduced as an appendix to the Audit Committeeproxy statement for the 2001 annual meeting of shareholders (2000 Charter). In March 2003, a new charter was adopted by the Board, and a copy of the Board (Committee)new charter is included as an appendix to this proxy statement. However, the new charter is effective May 1, 2003, and the Committee's activities described in this report for 2002 were performed pursuant to the 2000 Charter.

In accordance with the 2000 Charter, the Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Corporation.Company. During 2001,2002, the Committee met eighteleven times, including four meetings where the Committee discussed the interim financial information contained in each quarterly earnings announcement with the chief accounting officer and independent auditors prior to public release.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the CorporationCompany that might bear on the auditors' independence consistent with Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees," discussed with the auditors any relationships that may impact their objectivity and independence and satisfied itself as to the auditors' independence. The Committee also discussed with management, the internal auditors and the independent auditors the quality and adequacy of the Corporation'sCompany's internal controls and the internal audit function's organization, responsibilities, resources and staffing. The Committee reviewed with both the independent and the internal auditors their audit plans, audit scope, and identification of audit risks.

The Committee discussed and reviewed with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, "Communication with Audit Committees" and with and without management present,

discussed and reviewed the results of the independent auditors' examination of the financial statements. The Committee also discussed the results of the internal audit examinations.

The Committee reviewed the audited financial statements of the CorporationCompany for the year ended December 31, 2001,2002, with management and the independent auditors. Management has the responsibility for the preparation of the Corporation'sCompany's financial statements, and the independent auditors have the responsibility for the examination of those statements.

10

Based on the above-mentioned review and discussions with management and the independent auditors, the Committee recommended to the Board that the Corporation'sCompany's audited financial statements be included in its Annual Report on Form 10-K for the year ended December 31, 2001,2002, for filing with the Securities and Exchange Commission.

As specified in the 2000 Charter, it is not the duty of this Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with generally accepted accounting principles. These are the responsibilities of the Company's management and independent auditors. In discharging our duties as a Committee, we have relied on (i) management's representations to us that the financial statements prepared by management have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles, and (ii) the report of the independent auditors with respect to such financial statements.

15

Respectfully submitted,

Robert M. Beall, II, Chairman

H. Jesse Arnelle

Sherry S. Barrat

J. Hyatt Brown

Willard D. Dover

Alexander W. Dreyfoos, Jr.

COMPENSATION COMMITTEE REPORT

Fredric V. Malek

Compensation Committee Report

The Compensation Committee submits the following report for 2001:

2002:

FPL Group's executive compensation program is designed to align compensation with the Corporation'sCompany's business strategy, its goals and values, and the return to its shareholders. The program is also designed to provide a competitive compensation package, both in terms of its components and overall, that will attract and retain key executives critical to the success of the Corporation.

Company.

The Board of Directors adopted, and in 1994 and 1999 shareholders approved, an Annual Incentive Plan and a Long Term Incentive Plan that are intended to prevent, under normal circumstances, the loss of the federal income tax deductions available to the CorporationCompany for the amount of any compensation paid thereunder to the chief executive officer and the four other most highly-compensated officers. In accordance with these plans,Section 162(m) of the Committee

structuredInternal Revenue Code generally disallows a tax deduction to public companies for compensation exceeding $1 million paid to its named executive officers. However, certain portions of our named executive officers' compensation (in 2002, those portions being compensation earned under the 2001 executive compensation program toAnnual Incentive Plan and the Long Term Incentive Plan) may qualify for deduction under normal circumstances, all compensation paid thereunder to these officers,

and it162(m). The Compensation Committee intends to do likewise with thecontinue to take actions, including seeking shareholder approval of incentive plans, to ensure that our executive compensation programs meet the eligibility requirements under Section 162(m) of the Code. In some cases, it may not be possible to keep a given person's compensation under the Section 162(m) limit or to qualify all compensation for 2002

and future yearsdeductibility under Section 162(m) in a particular year, but that remains always the goal of this Committee. We strive to meet that goal as long as doing so is compatible with what the Committee considers to be a sound compensation program.

program, which is competitive and enables us to attract and retain the most capable management team possible in furtherance of the interests of the shareholders.

The Committee determines an executive's competitive total level of compensation based on information drawn from a variety of sources, including utility and general industry surveys, proxy statements, and independent compensation consultants. The Corporation'sCompany's 2002 "comparator group" consists of twelve electric utilities (all of which are included in the Dow Jones Electric Utilities Index and eleventen of which are included in the Standard & Poor's Electric Companies Index) and twelve telecommunications and general industry companies located in the Eastern United States. Electric utility industry trends (i.e., reregulation and increasing competition) and the need to recruit from outside the industry are the principal reasons for including companies other than electric utilities in the comparator group. In 2001, compensationCompensation for James L. Broadhead, Lewis Hay III, Paul J. Evanson, and Dennis P. Coyle Lawrence J. Kelleher, and Armando J.

Olivera was affected byalso must comply with the terms of their Employment Agreements (see "Employment Agreements" herein).

There are three components to the Corporation'sCompany's executive compensation program: base salary, annual incentive compensation, and long-term incentive compensation. In 2001,2002, the three components were structured so that base salary represented 25%27% to 60% of an executive officer's total targeted compensation, annual incentive compensation represented 15% to 25% of such compensation, and long-term incentive compensation represented 20%24% to 55%52% of such compensation. The more senior the position, the greater the portion of compensation that is based on performance.

11

Base salaries are set by the Committee and are designed to be competitive with the comparator group companies described above. Generally, the Committee targets salary levels between the second and third

16

quartiles of the comparator group, adjusted to reflect the individual's job experience and responsibilities. Increases in base salaries are based on the comparator group's practices, the Corporation'sCompany's performance, the individual's performance, and increases in cost of living indices. The corporate performance measures used in determining adjustments to executive officers' base salaries are the same performance measures used to determine annual incentive compensation, weighted as discussed below in regard to the chief executive officer's compensation. Base salaries are reviewed and adjusted annually. Employment Agreements in effect for Messrs. Broadhead,Lewis Hay III, Paul J. Evanson, Coyle, Kelleher, and OliveraDennis P. Coyle provide for each officer that his base salary shall be at least equal to his base salary as in effect in 2000 and shall be reviewed at least annually and increased substantially consistent with increases in base salary awarded to peer executives of the Corporation,Company, but not less than increases in the consumer price index.

Annual incentive compensation is based on the attainment of net income goals for the CorporationCompany, which are established by the Committee at the beginning of the year.year, and adjusted for specified items including any changes in accounting principles, any changes in the mark-to-market value of non-managed hedges, and certain charges or gains ("adjusted net income"). The amounts earned on the basis of this performance measure are subject to reduction based on the degree of achievement of other corporate performance measures (and in the case of Florida Power & Light Company ("FPL"), business unit performance measures), and in the discretion of the Committee. These other corporate performance measures, which for 20012002 consisted of the financial and operating indicators discussed below in regard to the chief executive officer's compensation, and business unit performance measures were also established by the Committee at the beginning of the year. For 2001,2002, the adjusted net income goal was met, and the average level of achievement of the other performance measures exceeded the targets. However, the amounts paid out for 20012002 were less than the amounts that could have been paid based on the attainment of the adjusted net income goal.

Long-term incentive compensation is based primarily on the average level of achievement under the annual incentive plans, typically over a four-year period for performance share awards, and on the average annual total shareholder return of FPL Group as compared to that of the Dow Jones Electric Utilities Index

companies,a peer group, typically over a three-year period, for shareholder value awards. In

2001, in accordance withPrior to 2002, the terms of their Employment Agreements, performance

share awards to certain executive officers (including those listed in the

Summary Compensation Table) were madepeer group for one-, two-, three-, and four-year

periods and shareholder value awards was the Dow Jones Electric Utilities Index companies. In 2002, for new shareholder value award grants and for grants previously made but not yet vested, the Committee changed the peer group to those officers were madethe Standard & Poor's Electric Companies Index companies, which the Committee determined was a more appropriate comparator group of companies for one-, two-,FPL Group. Targeted awards for both performance share and three-year periods. Targetedshareholder value awards, in the form of shares granted under the Corporation'sCompany's Long Term Incentive Plan, are made at the beginning of the period. Since one of the goals of the performance share program is to link directly the financial interests of FPL Group's shareholders and senior management, performance share award payouts (except for cash for the payment of incomes taxes) are made in shares of Common Stock which the recipient is expected, consistent with general guidelines, to hold for the duration of his or her employment. Long-term incentive compensation also includes stock options and restricted stock in amounts intended to ensure that the Corporation'sCompany's total executive compensation program is competitive, in terms of both composition and amount, with the compensation programs of other companies with which the CorporationCompany competes for executive talent.

For 2002, Mr. Broadhead wasHay, FPL Group's Chairman during 2001 and its chief executive officer, until June 11, 2001, and was Chairman and CEO of Florida Power & Light

Company during 2001. For his service in those capacities Mr. Broadhead was paid $1,100,000$880,000 in base salary, $100,000 of which he agreed to defer, $1,229,200$1,116,720 in annual incentive compensation, and $2,246,933$907,496 (consisting of 26,0515,082 shares of Common Stock and $898,794$186,747 in cash)cash for the performance share award payout and $440,629 in long term incentive compensation.

Mr. Broadhead was awarded optionscash for 250,000 shares of Common Stock and 50,000

shares of restricted stockthe shareholder value award payout) in accordance with the terms of his Employment

Agreement which became effective December 15, 2000. The options and restricted

stock were scheduled to vest 50% on February 12, 2002 and the balance on

February 12, 2003; however, in connection with Mr. Broadhead's retirement, and

partially as consideration for his services under a Consulting Agreement

(described herein under "Consulting Agreement and Certain Retirement

12

Benefits") the Committee determined to accelerate vesting to January 2, 2002.

Mr. Hay served as President of FPL Energy, LLC during 2001, and became FPL

Group's chief executive officer beginning June 11, 2001. For his service in

those capacities, Mr. Hay was paid $607,550 in base salary, $637,500 in annual

incentive compensation, and $416,432 (consisting of 4,828 shares of Common Stock

and $166,583 in cash) in long termlong-term incentive compensation. Mr. Hay was awarded options for 150,00075,000 shares of Common Stock and 22,50011,250 shares of restricted stock, all of which vest 50% on February 12, 2002 and the balance one year

later, in accordance with the terms of his Employment Agreement. In addition,

subsequent to his election as chief executive officer of FPL Group, and in light

of his increased responsibilities in that office, the Committee awarded him

options for an additional 50,000 shares of Common Stock, and 10,000 shares of

restricted stock, which vest one-third each year over the period ending

June 16, 2004.for three years. The base salaries of Messrs. Broadhead and Hay as chief executive officer of FPL

Group reflectsalary reflects the Committee's assessment of Mr. Broadhead's and Mr. Hay's overall performance and an analysis of the salaries of the chief executive officers in the comparator group. Mr. Broadhead's and

Mr. Hay's annual incentive compensation for 20012002 was based on the achievement of the Corporation'sCompany's adjusted net income goals, and the following performance measures for Florida Power & Light

Company ("FPL")FPL (weighted 75%) and the non-utility and/or new businesses (weighted 25%) and upon certain qualitative factors. For FPL, the

17

incentive performance measures were financial indicators (weighted 50%) and operating indicators (weighted 50%). The financial indicators were operations and maintenance costs, capital expenditure levels, adjusted net income, regulatory return on equity, and operating cash flow. The operating indicators were service reliability as measured by the frequency and duration of service interruptions and service unavailability; system performance as measured by availability factors for the fossil power plants and an industry index for the nuclear power plants; employee safety; number of significant environmental violations; customer satisfaction survey results; load management installed capability; and conservation programs' annual installed capacity. For the non-utility and/or new businesses, the performance measures included total combined return on equity; non-utility adjusted net income and return on equity; corporate and other net income;

creation of an asset optimization organization; employee safety; and number of significant environmental violations. The qualitative factors included measures to position the CorporationFPL Group for increased competition and initiating other actions that significantly strengthen the CorporationFPL Group and enhance shareholder value.

The

Mr. Hay's long-term compensation for 2002 consisted of payouts to Messrs. Broadheadunder a performance share award and Hay werea shareholder value award, each granted in 2001. The performance share award payout was based on an average level of achievement of better than 100% of target with respect to the annual incentive plan for the yearyears ended December 31, 2001.

2001 and December 31, 2002. As in 2002, the performance measures for 2001 were based on predefined financial, operational, and strategic objectives. The shareholder value award payout was determined by multiplying Mr. Hay's target number of shares by a factor derived by comparing the average annual total shareholder return of FPL Group (price appreciation or depreciation of FPL Group Common Stock plus dividends) to the median total shareholder return of the Standard & Poor's Electric Companies Index companies for the performance period beginning January 1, 2001 and ending December 31, 2002. The factor derived was greater than 160% and, as required by the plan, was reduced to the maximum payout level of 160% of the targeted award.

Respectfully submitted,

J. Hyatt Brown, Chairman

H. Jesse Arnelle

Robert M. Beall, II

James L. Camaren

Armando M. Codina

Paul R. Tregurtha

13

EXECUTIVE COMPENSATION

Frank G. Zarb

18

Executive Compensation

The following table sets forth compensation paid during the past three years to FPL Group's chief executive officersofficer and the other four most highly-compensated persons who served as executive officers of FPL Group, Florida Power & Light Company ("FPL"), or FPL Energy, LLC at December 31, 2001.

SUMMARY COMPENSATION TABLE

| | | Annual Compensation | Long-Term Compensation | | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year | Salary | Bonus | Other Annual Compensation | Restricted Stock Award(s)(a) | Securities Underlying Options(#) | LTIP Payouts(b) | All Other Compensation(c) | ||||||||||||||

| Lewis Hay III(d) | 2002 | $ | 880,000 | $ | 1,116,720 | $ | 20,215 | $ | 592,200 | 75,000 | $ | 907,496 | $ | 22,097 | ||||||||

| Chairman, President and CEO of | 2001 | 607,550 | 1,053,932 | 15,376 | 1,942,200 | 200,000 | — | 16,869 | ||||||||||||||

| FPL Group and Chairman and | 2000 | 423,000 | 449,300 | 14,099 | — | — | 6,696,320 | 15,661 | ||||||||||||||

| CEO of FPL | ||||||||||||||||||||||

Paul J. Evanson | 2002 | 724,200 | 663,700 | 14,986 | 493,500 | 75,000 | 1,937,523 | 11,643 | ||||||||||||||

| President of FPL | 2001 | 693,000 | 1,652,207 | 11,113 | 1,157,250 | 150,000 | — | 11,174 | ||||||||||||||

| 2000 | 660,000 | 660,700 | 11,105 | — | — | 10,395,654 | 8,544 | |||||||||||||||

Moray P. Dewhurst(e) | 2002 | 452,000 | 425,800 | 16,594 | 263,200 | 50,000 | 408,053 | 9,715 | ||||||||||||||

| Vice President, Finance and | 2001 | 181,100 | 406,404 | 25,121 | 1,107,000 | 100,000 | — | 2,555 | ||||||||||||||

| Chief Financial Officer of FPL | 2000 | — | — | — | — | — | — | — | ||||||||||||||

| Group and Senior Vice | ||||||||||||||||||||||

| President, Finance and Chief | ||||||||||||||||||||||

| Financial Officer of FPL | ||||||||||||||||||||||

Dennis P. Coyle | 2002 | 484,600 | 305,300 | 15,717 | 394,800 | 50,000 | 1,001,200 | 10,051 | ||||||||||||||

| General Counsel and | 2001 | 463,700 | 855,736 | 12,485 | 925,800 | 100,000 | — | 9,277 | ||||||||||||||

| Secretary of FPL Group and FPL | 2000 | 442,500 | 334,100 | 9,146 | — | — | 6,349,587 | 8,512 | ||||||||||||||

James L. Robo(f) | 2002 | 279,615 | 391,400 | 37,752 | 592,000 | 75,000 | — | 22,763 | ||||||||||||||

| President of FPL Energy, LLC | 2001 | — | — | — | — | — | — | — | ||||||||||||||

| 2000 | — | — | — | — | — | — | — | |||||||||||||||

- (a)

For - At December 31, 2002, Mr. Hay held 29,166 shares of restricted common stock with a value of $1,753,752, of which 11,250 shares were granted in 2002 and 17,916 were granted in 2001

represents annual incentive award payouts forand vest as to 18,333 shares in 2003, 7,083 shares in 2004, and 3,750 shares in 2005; Mr. Evanson held 18,750 shares of restricted common stock with a value of $1,127,438, of which 9,375 shares were granted in each ofthe officersyears 2002 and 2001 and vest asfollows:to 12,500 shares in 2003 and 3,125 shares in each of years 2004 and 2005; Mr.Broadhead $1,229,200, Mr. Hay $637,500, Mr. Evanson $707,200,Dewhurst held 20,000 shares of restricted common stock with a value of $1,202,600, of which 5,000 shares were granted in 2002 and 15,000 shares were granted in 2001 and vest as to 6,666 shares in 2003 and 6,667 shares in each of years 2004 and 2005; Mr. Coyle$343,100, Mr. Kelleher $270,500,held 15,000 shares of restricted common stock with a value of $901,950, of which 7,500 shares were granted in each of years 2002 and 2001 and vest as to 10,000 shares in 2003 and 2,500 shares in each of years 2004 and 2005; and Mr.Olivera $173,000. In addition, for 2001, representsRobo held 10,000 shares of restricted common stock with a value of $601,300 which were granted in 2002 and vest as to 3,334 shares in 2003 and 3,333 shares in each of years 2004 and 2005. Dividends at normal rates are paid on restricted common stock. - (b)

- For 2002, payouts of vested shareholder value awards were made in cash and payouts of vested performance share

award payouts under FPL Group's Long Term Incentive Plan 1994 for the performance period beginning January 1, 2001 and ending December 31, 2001. See note (c) below. The payout related to performance shareawardsfor each of the officers was as follows: Mr. Broadhead $2,246,933, Mr. Hay $416,432, Mr. Evanson $945,007, Mr. Coyle $512,636, Mr. Kelleher $395,267, and Mr. Olivera $205,706. Payoutswere made in a combination of cash (for payment of income taxes) and shares ofCommon Stock,FPL Group common stock, valued at the closing price on thelast business day preceding payout.date payouts were approved. Messrs. Evanson andOliveraDewhurst deferred their performance share award payouts under FPL Group's Deferred Compensation Plan.(b) At December 31, 2001, Mr. Broadhead held 50,000 shares of restricted Common Stock with a value of $2,820,000 that vest on January 2, 2002; Mr. Hay held 32,500 shares of restricted Common Stock with a value of $1,833,000 that vest as to 14,584 shares in 2002, 14,583 shares in 2003, and 3,333 shares in 2004; Mr. Evanson held 18,750 shares of restricted Common Stock with a value of $1,057,500 that vest as to 9,375 shares in each of years 2002 and 2003; Mr. Coyle held 15,000 shares of Restricted Common Stock with a value of $846,000 that vest as to 7,500 shares in each of years 2002 and 2003; Mr. Kelleher held 25,000 shares of restricted Common Stock with a value of $1,410,000 that vest as to 12,500 shares in each of years 2002 and 2003; Mr. Olivera held 16,000 shares of restricted Common Stock with a value of $902,400 that vest as to 8,000 shares in each of years 2002 and 2003. Dividends at normal rates are paid on restricted Common Stock. 14(c)For 2001,LTIPpayouts were based on a performance period of one fiscal year and, in accordance with SEC rules, are reported for 2001 under the "Bonus" column of this table. For 2000, upon a change of control as defined in the FPL Group, Inc. Long Term Incentive Plan 1994, on December 15, 2000, all performance criteria of performance-based awards, restricted stock and other stock-based awards held by executive officers were deemed fully achieved, and all such awards were deemed fully earned and vested. The performance criteria of performance-based awards were waived and the awards were paid out using an assumption of maximum performance forthe named officers. (d)Messrs. Hay, Evanson and Coyle.

19

- (c)

- For

2001,2002, represents employer matching contributionsof $8,075toemployeethrift plans of $6,211 for Mr. Robo and $9,500 for each of the other named officers, and employer contributions for life insurance as follows: Mr.Broadhead $512, Mr.Hay$8,794,$12,597, Mr. Evanson$3,099,$2,143, Mr. Dewhurst $215, Mr. Coyle$1,202, Mr. Kelleher $3,571,$551, and Mr.Olivera $3,388. (e)Robo $6,552. For Mr.Broadhead resigned as President and CEO of FPL Group on June 11, 2001, and resigned as Chairman of the Board of FPL Group and FPL and as CEO of FPL on December 31, 2001. (f)Robo, also includes $10,000 moving expense incentive. - (d)

- Mr. Hay joined FPL Group in July 1999 as Vice President, Finance and Chief Financial Officer of FPL Group and Senior Vice President, Finance and Chief Financial Officer of FPL. He served as President of FPL Energy, LLC from March 2000 to December 2001 and was elected President and

CEOChief Executive Officer of FPL Groupinon June 11, 2001. He was elected Chairman of the Board of FPL Group and FPL and Chief Executive Officer of FPLas ofon January 1, 2002.LONG TERM INCENTIVE PLAN AWARDS - (e)

- Mr. Dewhurst was appointed Vice President, Finance and Chief Financial Officer of FPL Group and Senior Vice President, Finance and Chief Financial Officer of FPL in July 2001.

- (f)

- Mr. Robo joined FPL Group in March 2002 as Vice President, Corporate Development and Strategy and was appointed President of FPL Energy, LLC in July 2002.

Long Term Incentive Plan Awards

In 2001,2002, performance share awards, shareholder value awards, and non-qualified stock option awards under FPL Group's Amended and Restated Long Term Incentive Plan were made to the executive officers named in the Summary Compensation Table as set forth in the following tables.

PERFORMANCE SHARE AWARDS

| | | | Estimated Future Payouts Under Non-Stock Price-Based Plans | |||||

|---|---|---|---|---|---|---|---|---|

| Name | Number of Shares (#) | Period Performance Until Payout | ||||||

| Target (#) | Maximum (#) | |||||||

| Lewis Hay III | 18,705 | 1/1/02—12/31/05 | 18,705 | 29,928 | ||||

| Paul J. Evanson | 9,796 | 1/1/02—12/31/05 | 9,796 | 15,674 | ||||

| Moray P. Dewhurst | 5,241 | 1/1/02—12/31/05 | 5,241 | 8,386 | ||||

| Dennis P. Coyle | 5,619 | 1/1/02—12/31/05 | 5,619 | 8,990 | ||||

| James L. Robo | 3,538 | 1/1/02—12/31/05 | 3,538 | 5,661 | ||||